Reconciliation of All-in Sustaining Costs perGold CAS / oz and Silver

Equivalent Ounce for Year Ended December 31,2017 | Silver | Gold | |

In thousands except per ounce amounts | Palmarejo | Rochester | Endeavor | Total | Kensington | Wharf | Total | Total |

Costs applicable to sales, including amortization (U.S. GAAP) | $ | 219,920 | | $ | 130,227 | | $ | 1,046 | | $ | 351,193 | | $ | 152,118 | | $ | 82,334 | | $ | 234,452 | | $ | 585,645 | |

Amortization | | 73,744 | | | 22,306 | | | 301 | | | 96,351 | | | 36,022 | | | 13,012 | | | 49,034 | | | 145,385 | |

Costs applicable to sales | $ | 146,176 | | $ | 107,921 | | $ | 745 | | $ | 254,842 | | $ | 116,096 | | $ | 69,322 | | $ | 185,418 | | $ | 440,260 | |

Silver equivalent ounces sold | | 15,490,734 | | | 8,209,888 | | | 107,027 | | | 23,807,649 | | | | | | | | | | | | 37,334,889 | |

Gold equivalent ounces sold | | | | | | | | | | | | | | 125,982 | | | 99,472 | | | 225,454 | | | | |

Costs applicable to sales per ounce | $ | 9.44 | | $ | 13.15 | | $ | 6.96 | | $ | 10.70 | | $ | 922 | | $ | 697 | | $ | 822 | | $ | 11.79 | |

Inventory adjustments | | (0.08 | ) | | (0.07 | ) | | — | | | (0.08 | ) | | (2 | ) | | 3 | | | — | | | (0.05 | ) |

Adjusted costs applicable to sales per ounce | $ | 9.36 | | $ | 13.08 | | $ | 6.96 | | $ | 10.62 | | $ | 920 | | $ | 700 | | $ | 822 | | $ | 11.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Costs applicable to sales per average spot ounce | $ | 8.45 | | $ | 12.04 | | | | | $ | 9.66 | | | | | | | | | | | $ | 10.24 | |

Inventory adjustments | | (0.07 | ) | | (0.07 | ) | | | | | (0.07 | ) | | | | | | | | | | | (0.04 | ) |

Adjusted costs applicable to sales per average spot ounce | $ | 8.38 | | $ | 11.97 | | | | | $ | 9.59 | | | | | | | | | | | $ | 10.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Costs applicable to sales | $ | 440,260 | |

Treatment and refining costs | | 5,912 | |

Sustaining capital(1) | | 65,010 | |

General and administrative | | 33,616 | |

Exploration | | 30,311 | |

Reclamation | | 14,910 | |

Project/pre-development costs | | 5,543 | |

All-in sustaining costs | $ | 595,562 | |

Silver equivalent ounces sold | | 23,807,649 | |

Kensington and Wharf silver equivalent ounces sold | | 13,527,240 | |

Consolidated silver equivalent ounces sold | | 37,334,889 | |

All-in sustaining costs per silver equivalent ounce | $ | 15.95 | |

Inventory adjustments | $ | (0.05 | ) |

Adjusted all-in sustaining costs per silver equivalent ounce | $ | 15.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated silver equivalent ounces sold (average spot) | | 42,969,841 | |

All-in sustaining costs per average spot silver equivalent ounce | $ | 13.86 | |

Inventory adjustments | $ | (0.04 | ) |

Adjusted all-in sustaining costs per average spot silver equivalent ounce | $ | 13.82 | |

| | Costs applicable to sales, including amortization (U.S. GAAP) | | | $143,983 | | | $100,418 | | | $171,204 | | | $102,108 | | | $26,580 | | | $544,293 | | | $517,713 | |

| | Amortization | | | (37,603) | | | (14,306) | | | (49,477) | | | (12,473) | | | (8,923) | | | (122,782) | | | (113,859) | |

| | Costs applicable to sales | | | $106,380 | | | $86,112 | | | $121,727 | | | $89,635 | | | $17,657 | | | $421,511 | | | $403,854 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Metal Sales | | | | | | | | | | | | | | | | | | | | | | |

| | Gold ounces | | | 93,898 | | | 26,257 | | | 124,793 | | | 94,379 | | | | | | 339,327 | | | 339,327 | |

| | Silver ounces | | | 5,426,875 | | | 3,054,139 | | | | | | 113,790 | | | 158,984 | | | 8,753,788 | | | 8,594,804 | |

| | Zinc pounds | | | | | | | | | | | | | | | 3,203,446 | | | 3,203,446 | | | — | |

| | Lead pounds | | | | | | | | | | | | | | | 2,453,485 | | | 2,453,485 | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Costs applicable to sales | | | | | | | | | | | | | | | | | | | | | | |

| | Gold ($/oz) | | | $589 | | | $1,377 | | | $975 | | | $923 | | | | | | $931 | | | $895 | |

| | Silver ($/oz) | | | $9.41 | | | $16.35 | | | | | | | | | NM(2) | | | $12.06 | | | $11.65 | |

| | Zinc ($/lb) | | | | | | | | | | | | | | | NM(2) | | | | | | | |

| | Lead ($/lb) | | | | | | | | | | | | | | | NM(2) | | | | | | | |

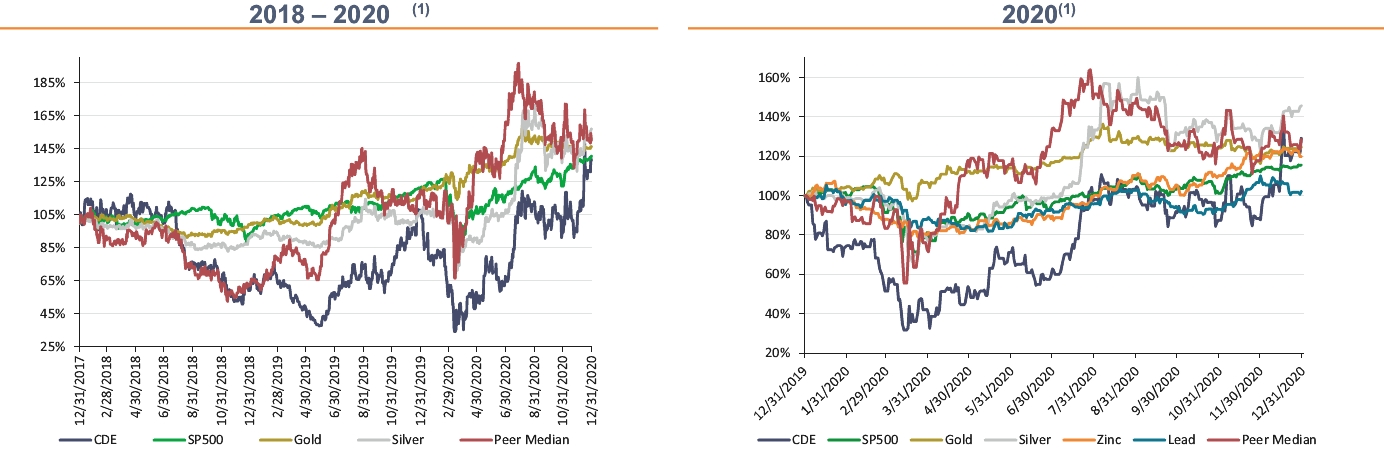

(1)

| Includes full-year 2020 financial and production results excluding the second quarter of 2020. |

(2)

| Due to the temporary suspension of mining and processing activities these amounts are not meaningful. |

| | Costs applicable to sales, including amortization (U.S. GAAP) | | | $201,306 | | | $118,246 | | | $170,194 | | | $92,969 | | | $145,496 | | | $728,211 | |

| | Amortization | | | (59,379) | | | (18,041) | | | (50,592) | | | (12,280) | | | (36,738) | | | (177,030) | |

| | Costs applicable to sales | | | $141,927 | | | $100,205 | | | $119,602 | | | $80,689 | | | $108,758 | | | $551,181 | |

| | | | | | | | | | | | | | | | | | | | | |

| | Metal Sales | | | | | | | | | | | | | | | | | | | |

| | Gold ounces | | | 116,104 | | | 36,052 | | | 130,495 | | | 84,999 | | | | | | 367,650 | |

| | Silver ounces | | | 6,841,380 | | | 3,844,556 | | | | | | 64,161 | | | 1,164,470 | | | 11,914,567 | |

| | Zinc pounds | | | | | | | | | | | | | | | 18,154,521 | | | 18,154,521 | |

| | Lead pounds | | | | | | | | | | | | | | | 16,487,847 | | | 16,487,847 | |

| | | | | | | | | | | | | | | | | | | | | |

| | Costs applicable to sales | | | | | | | | | | | | | | | | | | | |

| | Gold ($/oz) | | | $685 | | | $1,246 | | | $917 | | | $937 | | | | | | $878 | |

| | Silver ($/oz)(1) | | | $9.13 | | | $14.38 | | | | | | | | | 31.92 | | | $16.69 | |

| | Zinc ($/lb) | | | | | | | | | | | | | | | 2.34 | | | | |

| | Lead ($/lb) | | | | | | | | | | | | | | | 1.76 | | | | |

(1)

| Consolidated includes zinc and lead as silver equivalent. |

TABLE OF CONTENTS

Reconciliation of All-in Sustaining Costs per SilverEquivalent Ounce for Year Ended December 31,2016

| Silver | Gold | |

In thousands except per ounce amounts | Palmarejo | Rochester | Endeavor | Total | Kensington | Wharf | Total | |

Costs applicable to sales, including amortization (U.S. GAAP) | $ | 117,419 | | $ | 111,564 | | $ | 2,363 | | $ | 231,346 | | $ | 131,518 | | $ | 87,000 | | $ | 218,518 | | $ | 449,864 | |

Amortization | | 36,599 | | | 21,838 | | | 644 | | | 59,081 | | | 34,787 | | | 20,621 | | | 55,408 | | | 114,489 | |

Costs applicable to sales | $ | 80,820 | | $ | 89,726 | | $ | 1,719 | | $ | 172,265 | | $ | 96,731 | | $ | 66,379 | | $ | 163,110 | | $ | 335,375 | |

Silver equivalent ounces sold | | 7,538,311 | | | 7,542,740 | | | 262,078 | | | 15,343,129 | | | | | | | | | | | | 29,221,609 | |

Gold equivalent ounces sold | | | | | | | | | | | | | | 121,688 | | | 109,620 | | | 231,308 | | | | |

Costs applicable to sales per ounce | $ | 10.72 | | $ | 11.90 | | $ | 6.56 | | $ | 11.23 | | $ | 795 | | $ | 606 | | $ | 705 | | $ | 11.48 | |

Inventory adjustments | | (0.17 | ) | | (0.04 | ) | | — | | | (0.11 | ) | | (5 | ) | | (31 | ) | | (17 | ) | | (0.19 | ) |

Adjusted costs applicable to sales per ounce | $ | 10.55 | | $ | 11.86 | | $ | 6.56 | | $ | 11.12 | | $ | 790 | | $ | 575 | | $ | 688 | | $ | 11.29 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Costs applicable to sales per average spot ounce | $ | 9.73 | | $ | 10.97 | | | | | $ | 10.29 | | | | | | | | | | | $ | 9.98 | |

Inventory adjustments | | (0.16 | ) | | (0.04 | ) | | | | | (0.10 | ) | | | | | | | | | | | (0.17 | ) |

Adjusted costs applicable to sales per average spot ounce | $ | 9.57 | | $ | 10.93 | | | | | $ | 10.19 | | | | | | | | | | | $ | 9.81 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Costs applicable to sales | $ | 335,375 | |

Treatment and refining costs | | 4,307 | |

Sustaining capital(1) | | 71,134 | |

General and administrative | | 29,275 | |

Exploration | | 12,930 | |

Reclamation | | 13,291 | |

Project/pre-development costs | | 5,779 | |

All-in sustaining costs | $ | 472,091 | |

Silver equivalent ounces sold | | 15,343,129 | |

Kensington and Wharf silver equivalent ounces sold | | 13,878,480 | |

Consolidated silver equivalent ounces sold | | 29,221,609 | |

All-in sustaining costs per silver equivalent ounce | $ | 16.16 | |

Inventory adjustments | $ | (0.19 | ) |

Adjusted all-in sustaining costs per silver equivalent ounce | $ | 15.97 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated silver equivalent ounces sold (average spot) | | 33,600,783 | |

All-in sustaining costs per average spot silver equivalent ounce | $ | 14.05 | |

Inventory adjustments | $ | (0.17 | ) |

Adjusted all-in sustaining costs per average spot silver equivalent ounce | $ | 13.88 | |

TABLE OF CONTENTS

Consolidated Free Cash Flow Reconciliation

(Dollars in thousands) | 2017 | 2016 |

Cash flow from continuing operations | $ | 197,160 | | $ | 96,461 | |

Capital expenditures from continuing operations | | 136,734 | | | 94,382 | |

Gold production royalty payments | | — | | | 27,155 | |

Free cash flow | | 60,426 | | | (25,076 | )) |

Wharf Free Cash Flow Reconciliation

(Dollars in thousands) | 2017 | 2016 | 2015 |

Cash flow from continuing operations | $ | 49,611 | | $ | 62,417 | | $ | 31,955 | |

Capital expenditures from continuing operations | | 8,844 | | | 4,812 | | | 3,211 | |

Free cash flow | | 40,767 | | | 57,605 | | | 28,744 | |

Average Spot Prices

| 2017 | 2016 | 2015 |

Average Silver Spot Price Per Ounce | $ | 17.05 | | $ | 17.14 | | $ | 15.68 | |

Average Gold Spot Price Per Ounce | $ | 1,257 | | $ | 1,251 | | $ | 1,160 | |

Average Silver to Gold Spot Equivalence | | 74:1 | | | 73:1 | | | 74:1 | |

Reserves, Resources and Mineralized Material

Coeur Mining, Inc. is subject to the reporting requirements of the Exchange Act and applicable Canadian securities laws, and as a result we report our mineral reserves according to two different standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum. U.S. reporting requirements, however, are governed by Industry Guide 7 (“Guide 7”). Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported but embody different approaches and definitions. Under Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

In our public filings in Canada and in certain other announcements not filed with the SEC, we disclose measured, indicated and inferred resources, each as defined in NI 43-101, in addition to our mineral reserves. U.S. investors are cautioned that, while the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” are recognized and required by Canadian securities laws, Guide 7 does not recognize them. The estimation of measured resources and indicated resources involve greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves, and therefore U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into Guide 7 compliant reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources, and therefore it cannot be assumed that all or any part of inferred resources will ever be upgraded to a higher category. Therefore, investors are cautioned not to assume that all or any part of inferred resources exist, or that they can be mined legally or economically.

In this proxy statement and in our other filings with the SEC, we modify our estimates made in compliance with NI 43-101 to conform to Guide 7 for reporting in the United States. In this proxy statement, we use the term “mineralized material” to describe mineralization in mineral deposits that do not constitute “reserves” under U.S. standards. “Mineralized material” is substantially equivalent to measured and indicated mineral resources (exclusive of reserves) as disclosed for reporting purposes in Canada, except that the SEC only permits issuers to report

"mineralized material"“mineralized material” in tonnage and average grade without reference to contained ounces. We provide disclosure of mineralized material to allow a means of comparing our projects to those of other companies in the mining industry, many of which are Canadian and report pursuant to NI 43-101, and to comply with applicable disclosure requirements. We caution you not to assume that all or any part of mineralized material will ever be converted into Guide 7 compliant reserves.